Table of Content

Additionally, if you're looking for a plan to cover your basic wants at a low price, Medicare Supplement Plan N or High Deductible Plan G could make the most sense on your scenario. The easiest approach to determine suitable protection is by permitting a licensed agent to guide you through a side-by-side plan comparison and estimate your annual out-of-pocket prices. Medicare Supplement plans step in to assist cowl these prices by filling in these gaps Original Medicare coverage alone leaves. These policies present predictable healthcare costs in your future. And, if you have a Plan J with a high deductible choice, you should pay the first $2,340 earlier than the coverage pays anything. A one-time solely, 6-month interval when federal law permits you to buy any Medigap coverage you want that's offered in your state.

For instance, if you waited three years after your Initial Enrollment Period to join for Medicare Part B, your late enrollment penalty might be 30 % of the Part B premium. If you are admitted to a hospital for inpatient therapy, Medicare Part A helps cover your hospital prices when you reach your Medicare Part A deductible. The Part A deductible is $1,600 per benefit period in 2023. Part A can embrace a number of costs, together with premiums, a deductible and coinsurance.

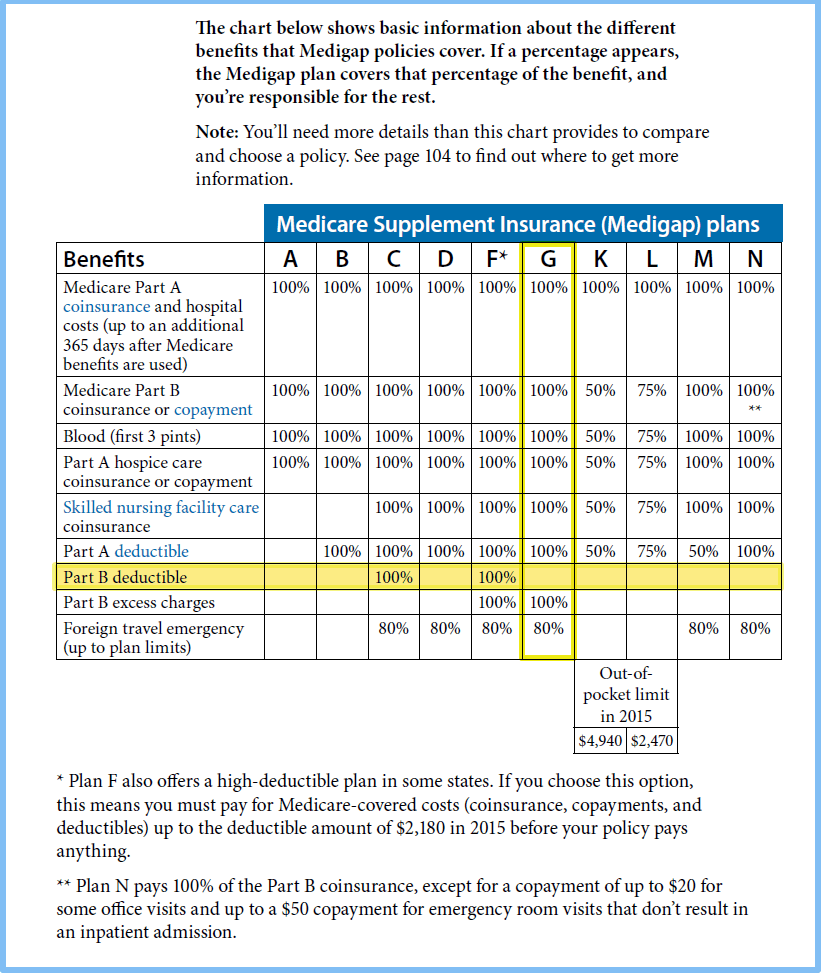

Medicare Supplement Plans In Texas

You can also be charged 5 % coinsurance for inpatient respite care prices. While at HelpAdvisor, Christian has written tons of of articles that teach Medicare beneficiaries the best practices for navigating Medicare. One massive issue within the prices of Medicare Supplemental Insurance plan is the level of protection supplied. There are nine benefit areas coated by the 10 standardized Medigap insurance coverage that are obtainable in most states. The coverage of every plan is standardized by the federal government and remains constant throughout every carrier in every state. Medicare Supplement Plan K comes with 50% cost-sharing, making the average month-to-month premium price of your Medigap plan lower than most.

However, Medicare Supplement prices corresponding to premiums will range by recipient. Three vital factors that influence your Medicare Supplement charges are your location, age, and gender. The Part D late enrollment penalty is 1% of the typical Part D premium for every month you delay enrollment.

A Medicare Complement Insurance Coverage Plan May Help Cut Back Out-of-pocket Prices

Open enrollment interval, you could be subject to medical underwriting by the insurance coverage company. This means that the value of your Medicare Supplement Insurance plan could also be based in your current health standing and medical history. Deductibles, copayments, & coinsuranceVaries by plan and pharmacy.Find Medicare drug plans in your space, and examine their costs and coverage. It’s essential to check Medigap insurance policies for the rationale that costs can differ between plans provided by different corporations for exactly the same protection, and should go up as you get older. The average cost of Medicare Supplement Plan N premiums skews decrease than these of the other two of the top three Medigap plan options.

Learn how benefits are coordinated when you may have Medicare and other medical insurance. Some plans would possibly increase your price for every year that you age whereas enrolled within the plan. Medicare Supplement Insurance firms sometimes value their plans in one of three ways based on age. You may also discover that areas with extra plan choices could have decrease costs because of the elevated competition. The cost of dwelling may be considerably completely different in one market compared to another. It’s not unusual for a product to cost more in a big city than it does in a more rural setting, and the identical could be said for Medicare Supplement Insurance plans.

The deductible amount varies primarily based on which plan you be part of. $1,556($1,600 in 2023) for each time you’re admitted to the hospital per profit period, earlier than Refer to Medicare glossary for more particulars. 9 Factors That Impact Your Medicare Supplement RatesMany components can impact your Medicare Supplement charges.

Medicare Part A requires a coinsurance payment of $200 per day in 2023 for inpatient expert nursing facility stays longer than 20 days. You are responsible for all prices after day a hundred and one of an inpatient skilled nursing facility keep. It covers a few of your prices when you're admitted for inpatient care at a hospital, expert nursing facility and another forms of inpatient amenities.

10 standardized Medigap policies to choose from, and every plan provides a unique mixture of primary benefits. You might need to cancel your Medicare Supplement plan since you wish to change to a unique plan. You can cancel the plan anytime so lengthy as you notify your medical insurance firm in writing. Plan N covers Medicare Part B coinsurance, but youpay copayments for coated doctor office and emergency room visits in change for a mid-level premium.

Rather,Medicare Supplement Insurance works alongside Original Medicare to help fill in a variety of the above coverage gaps. Medigap and Medicare-based insurance coverage packages differ considerably. You can apply for each types of Medicare when you have Medicare Parts AB and C, but can solely apply concurrently to every. Medicare Advantage and Medigrap plans may be purchased by a non-public Medicare agency. If you select to delay your Social Security or Railroad Retirement Board retirement advantages, you'll not be mechanically enrolled in Medicare whenever you flip sixty five. In this case, you'll have to manually enroll if you want to be lined by Medicare.

You must meet this $2,490 plan deductible earlier than your plan protection kicks in for the relaxation of the plan 12 months. One tradeoff for the excessive deductible is a lower monthly premium. After you meet your Part B deductible, you might be sometimes required to pay a coinsurance or copay of 20 % of the Medicare-approved quantity for your covered providers. You can compare Part D plans out there where you live and enroll in a Medicare prescription drug plan on-line when you visit MyRxPlans.com. You can combine a Medigap plan with a Medicare Part D prescription drug plan, which might help cowl your costs for retail prescription drugs. Medicare Supplement Insurance plan premiums are sold by private insurance coverage firms.

These Medicare Supplement Plans are FXMedicare Supplement Plans are among the more complicated Medicare Supplement plans on the planet. This plan supplies protection for the complete Original Medicare coinsurance and deductible, leaving you without out-of-pocket expenses. Medicare Supplement Plan G If I turn 60 this year Medicare Supplement Plan G will present the most effective health care package out there. You may also take into consideration Medicare Supplemental Insurance Program. Medicare Supplements Plans NxMedicaria Supplements plans have a selection of standardized Medigap plans.

Changing your Medigap plan is easy with no medical underwriting. Nonetheless, these incentives only apply to individuals enrolled in Medicare Supplement plans. Washington does not allow beneficiaries with Medigap plans to enroll in an MSOEP plan. The benefit ought to last for a full 90-day period if it is out there. A 65-year-old man in Washington has paid a median of $33.6 for a Medigap Plan N from Cignaa, which prices less.

Medicare Supplement Insurance insurance policies are also referred to as Medigap policies. It's simple to give consideration to just premiums when taking a glance at how a lot a plan can value. Premiums are common monthly bills that must fit right into a budget, and most of us are aware of our monthly expenses. But it's a greater idea to have a look at all your Medicare costs together—including both your premiums and all out-of-pocket prices. Because generally a plan might seem like a good selection with a low premium but may very well price you more with excessive out-of-pocket costs. For example, a plan with a low month-to-month premium may find yourself costing you more.

No comments:

Post a Comment