Table of Content

- Half A Deductible

- Applications Of All-inclusive Care For The Aged (pace):

- Select Your Medicare Physician And Your Hospital

- How Much Does Medicare Advantage Value Per Month?

- Do I Qualify For Medicare Supplement Plans In Texas If I Acquire Disability?

- Which Medicare Complement Plan Has The Highest Level Of Coverage?

Part D plan costs can range widely, even for comparable protection. You may pay a Part A premium when you or your partner haven’t worked and paid taxes for at least 10 years. Part B has a month-to-month premium you pay on to Medicare, and the quantity you pay can vary primarily based on your revenue stage. Other costs you might pay with Original Medicare include deductibles, coinsurance and copays. You wont pay a late-enrollment penalty so long as you join Part D within two months of dropping that protection. If your insurer cancels your Medigap coverage, then guaranteed problem rights might help you transition to a different plan without having to bear a well being screening and paying a premium penalty.

Medicare Part A covers inpatient prices, and Part B covers outpatient costs. NoteFor extra information about how Medigap plans are priced or rated, seecosts of Medigap insurance policies. Medicare doesn't sometimes provide protection for emergency care obtained outside of the U.S. or U.S. territories. Original Medicare does not provide protection for the first three pints of blood which are utilized in a blood transfusion. There isn't any coinsurance requirement for the first 20 days of inpatient expert nursing facility care. After your ninetieth day within the hospital, you have to pay $800 per day for as much as 60 more days.

Part A Deductible

In addition, your insurer can't cancel your coverage because you moved as lengthy as you are paying your premiums. But there are some circumstances when you might want to change plans. And you may find a way to save extra when you can cancel your Medicare Advantage plan, Part D prescription drug plan or different further health-related insurance you might be shopping for. UnitedHealthcare offers quite so much of Medicare Supplement plans with totally different prices and levels of protection. AARP UnitedHealthcare Medicare Advantage plans have in depth illness management applications to assist beneficiaries stay on top of chronic conditions — hopefully lowering future health-care prices.

Unless you purchase at sure times, an insurer might reject you or cost more because of preexisting health situations. You can change Medicare supplement plans at any time of yr however in most states you'll have to pass medical underwriting to take action. However, there is not a approach to change from Medicare Advantage to Medicare Supplement directly.

Programs Of All-inclusive Care For The Aged (pace):

High Deductible Medicare Supplement Plan F provides the same benefits as normal Medicare Supplement Plan F, however you should attain the next deductible before receiving protection. While it may take a while to succeed in the deductible, the typical month-to-month premium for High Deductible Medicare Supplement Plan F premiums is lower. The amount you pay is decided by the protection you select, the health care companies and benefits you employ in the course of the yr, and if your insurance coverage plan has rules about in and out-of-network prices. Contact could additionally be made by a Licensed Insurance Agent or Insurance Company. The Medicare Supplement Insurance Plans are guaranteed renewable as long as the required premium is paid by the end of each grace interval.

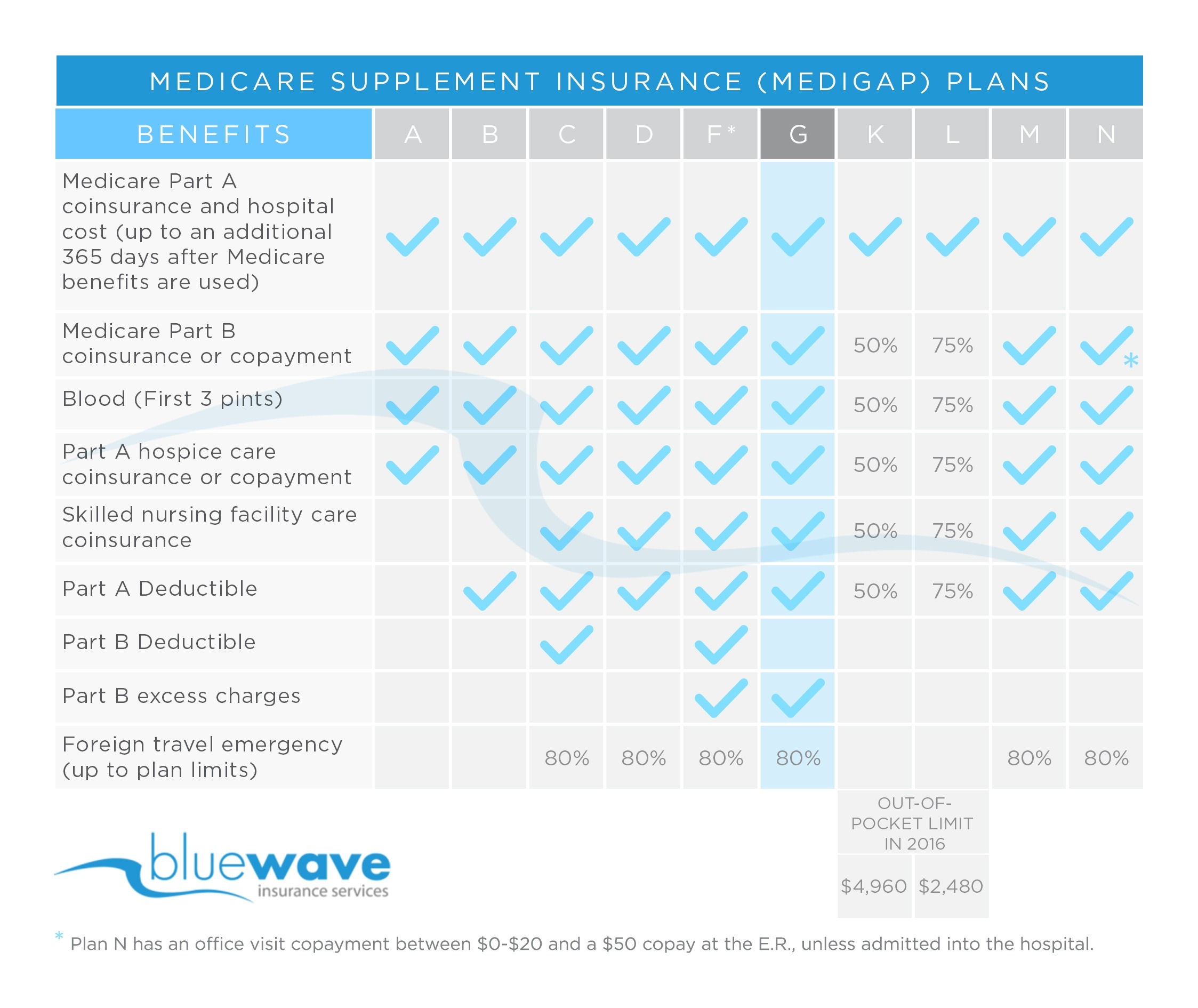

You can see from the desk above that your Medicare Supplement costs may be greater at seventy five in comparability with 65 years old. Below, you will note the average cost of Medicare Supplement Plan F premiums is a bit greater than the opposite plans, starting from $251 to $524 for our examples. It’s necessary to check Medigap policies since the costs can differ and should go up as you get older. The chart below reveals fundamental information about the different benefits that Medicare complement Plans cowl. If a percentage seems, the Medigap plan covers that share of the profit, and you’re liable for the rest.

It’s not unusual for insurance coverage firms to offer discounts on Medicare Supplement Insurance plans. Discounts are sometimes obtainable for non-smokers, married couples and different criteria. Be positive to ask your insurance agent or insurance carrier about any potential reductions that could be out there.

Premiums may enhance because of inflation and other components. Rodolfo Marrero is one of the co-founders at Medigap.com. He has been serving to consumers find the best coverage because the website was founded in 2013. Rodolfo is a licensed insurance coverage agent that works hand-in-hand with the team to ensure the accuracy of the content.

Select Your Medicare Physician And Your Hospital

If you apply exterior of Open Enrollment or Guaranteed Issue periods, you could be denied coverage or charged more primarily based in your health historical past. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare complement plans are guaranteed out there. The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is assured. If your group well being plan or retiree protection is the secondary payer, you may have to enroll in Medicare Part B earlier than theyll pay. This is a maximum amount of out-of-pocket costs you pay per calendar 12 months.

Under community-rated Medigap plan pricing, each Medicare beneficiary is charged the same rate, no matter their age. The value of the plan won't enhance over time on account of the rising age of the insured, however prices might enhance as a outcome of inflation. The value of the same Medicare Supplement Insurance plan providing the same fundamental advantages may range from $218 to $444. You might pay a month-to-month penalty if you don’t join Part B when you’re first eligible for Medicare . You’ll pay the penalty for so lengthy as you could have Part B. The penalty goes up the longer you wait to signal up. Find out how the Part B penalty works and the means to keep away from it.

How Much Does Medicare Advantage Value Per Month?

For instance, should you waited three years after your Initial Enrollment Period to enroll in Medicare Part B, your late enrollment penalty might be 30 p.c of the Part B premium. If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital prices when you attain your Medicare Part A deductible. The Part A deductible is $1,600 per profit period in 2023. Part A can embrace a number of costs, including premiums, a deductible and coinsurance.

10 standardized Medigap insurance policies to choose from, and every plan offers a novel mix of fundamental advantages. You could need to cancel your Medicare Supplement plan because you want to change to a unique plan. You can cancel the plan anytime so lengthy as you notify your medical health insurance company in writing. Plan N covers Medicare Part B coinsurance, however youpay copayments for coated doctor office and emergency room visits in exchange for a mid-level premium.

In truth, Plan F covers all 9 of the standardized Medigap advantages a plan could supply. A particular Medigap plan might give you the outcomes you want if it presents coverage that works for your wants and comes with premiums that suit your price range. Read about Medigap , which helps pay some of the health care prices that Original Medicare would not cover.

No comments:

Post a Comment